First Time Builder

First Home Owners’ Grant New South Wales

Rising house prices and a shortage of affordable homes means that getting onto the property ladder in NSW can be a challenge. To make it easier for local people to get onto the property ladder, the NSW government has introduced a number of different measures designed to ease the financial burden of buying your first home, as well as increasing the supply of lower cost housing.

One of the main methods of helping out first-time buyers is the first home owners’ grant. Designed to give prospective homeowners a boost, government grants for first home buyers can enable individuals to save thousands on the cost of their first property.

Read on to find out more about the first home owners’ grant NSW residents can apply for.

Quick Links

- About the First Home Owners’ grant

- About the 2020 First Home Loan deposit scheme

- About the HomeBuilder Grant program

About the First Home Owners’ Grant

How Does The First Home Owners’ Grant Work?

As the name suggests, first time home buyers grants are available for individuals or couples who haven’t bought a home previously. A first time home buyer can apply for a first home grant of $10,000 towards the cost of a new-build property. The property must be one that hasn’t been owned or lived in before. It can be purchased from a developer or built on the individual’s land by an independent contractor. In some circumstances, a new home owner’s grant can be paid to individuals who have purchased an existing property which has been extensively modified or brought back into use. Note that these applications are judged on an individual basis: in general, the grant isn’t available for the purchase of existing properties.

Can you get a First Home Owners’ Grant on existing homes?

Usually, the New South Wales First Home Owners’ Grant isn’t available towards the purchase of an existing home. If a property has been remodelled or significantly refurbished, it may be eligible. Circumstances where this might happen include where a derelict property has been brought back into use or where a building has changed use from non-residential to residential (for example, the conversion of an old warehouse into apartments).

How much is the First Home Owners’ Grant in NSW?

In NSW, the First Home Owners’ Grant is $10,000. This could change in the future, as the NSW government sets its annual budget. In other states, decreases in the government grant for first home buyers have occurred in the past.

When does the First Home Owners’ Grant get paid to successful applicants?

If you are purchasing a new property from a developer, the grant is paid once the transaction is complete. For people who are commissioning their own new-build property, the grant is paid once building work is in progress – usually once the foundations have been laid.

Eligibility

What would make me ineligible for the First Home Owners’ Grant?

The eligibility criteria for the first home owners grant in New South Wales can vary depending on specific circumstances and the details can be found here. Some important general criteria that needs to be satisfied includes:

- Applicant(s) must be over 18 years old.

- Applicant(s) must be Australian residents, have leave to remain or be covered under a specific agreement which Australia has with another country (for example, some New Zealand nationals are eligible).

- The grant must be for a first property. For joint applications, both applicants must not have been previous homeowners.

- The grant must be to purchase a home, rather than an office, factory or home-to-let.

- Grants are only paid out for new-build properties that have not been lived in or owned before. Properties may be commissioned on an individual basis, or purchased from a developer.

- You will need to live in your home for at least twelve months and move in within twelve months of completing the purchase.

- To receive the grant, the purchase price of the home must be less than $600,000. If you are building your own property, it must be valued at less than $750,000 in order to receive the $10,000 grant.

Applying for The First Home Owners’ Grant

How do I apply for the First Home Owners’ Grant?

In the first instance, potential grant beneficiaries need to fill in the First Home Owners’ Grant application. The First Home Owners’ Grant application form captures everything needed for the government to make a decision regarding eligibility.

If you believe that you are eligible for the home owners’ grant, it’s important to apply as soon as possible. In other states, the grant levels have been reduced in recent years and there is no guarantee that that won’t happen in NSW in future. For this reason, it makes sense to apply as soon as you have decided to build your own home or purchase a new property from a developer. Particularly if you are buying on a budget, the home owners’ grant can make a real difference to your home purchasing power.

Is the First Home Owners’ Grant still available in NSW?

Yes! At the time of writing the new home owners grant is still available.

When does the First Home Owners’ Grant end in NSW?

At the moment there are no plans to end the grant. That said, as fresh government budgets are set in subsequent years, there may be changes to the grant amounts, or it may end at a future date.

FAQS

Does the First Home Owners’ Grant count towards a deposit?

Potentially, yes! There is no reason why the grant can’t be used towards a deposit, but remember that it’s not paid until the sales transaction is complete. Some mortgage providers may want to see cash up front, rather than wait until completion before receiving the deposit money. Different mortgage providers have different policies on this: your provider will be best placed to advise.

Can you use the First Home Owners’ Grant to buy land?

No! Land can’t be purchased using the government grant for first home buyers. If you are a first-time buyer who intends to purchase land on which to build a home, the sale will be exempt from stamp duty provided it is less than $350,000. You will also enjoy a rebate on a percentage of stamp duty on land valued at between $350,000 and $450,000.

Can you get the First Home Owners’ Grant if you’re married?

Yes! Provided you and your spouse both meet the relevant eligibility criteria, you can then apply for the grant.

Can permanent residents get the First Home Owners’ Grant?

Yes! Permanent residents are eligible to apply.

Can you get the First Home Owners’ Grant twice?

No! The grant is only available on a one-off basis for the first property purchase made. A joint application isn’t valid if one of the parties has already benefited from a grant.

Do first home buyers pay stamp duty in NSW?

The amount of stamp duty paid by first home buyers depends on the value of the property purchase. If a property costs less than $650,000 (or is valued at less than $750,000 if the property is built for the home buyer), full duty relief is granted. Purchases above this amount incur an increasing amount of stamp duty, calculated according to the sale price.

Can you get the First Home Owners’ Grant on existing homes?

The eligibility criteria when it comes to the first home buyers’ grant existing property options are quite complex. Generally, existing homes aren’t eligible (although first home buyers still enjoy stamp duty exemption if they buy an existing property). That said, where extensive remodelling or restructuring has taken place, there may be a case for an existing structure to be eligible. Examples of this include where buildings have been converted from non-residential to residential use or where a derelict building has been brought back into commission.

About The 2020 First Home Loan deposit scheme

The 2020 First Home Loan Deposit Scheme, which began on January 1st 2020, encourages new home buyers through financial incentive. The scheme allows you to enter a mortgage with significantly lower fees, and only requires a deposit totalling 5% of the value of the property being purchased. While banks and lenders usually require 20% of the property’s value as part of a deposit to be exempt from extra fees, while under this scheme this number is lowered to just 5%.

The federal government will act as your guarantor and underwrite your loan and so that Lender’s Mortgage Insurance (LMI) fees do not apply. The scheme aims to provide financial assistance to new home buyers, making it far easier to take the next step into home ownership.

Read more about this national scheme here.

About The HomeBuilder Grant program

The HomeBuilder Grant is a nationwide stimulus package that has been formulated as a response to the economic hardship from COVID-19. The grant will apply to both renovations and new homes, and will total $25,000.

For new homes, the property value cannot exceed $750,000. Renovations cannot exceed $150,000 and cannot include pools or tennis courts. Singles must be earning $125,000 or less based on their tax return, and couples must have a combined income of less than $200,000.

Read more about this national scheme here.

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

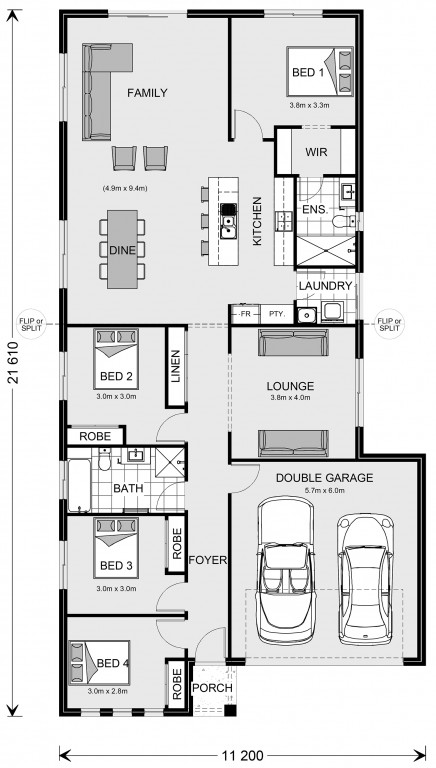

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information about the First Home Owners Grant is available at http://www.firsthome.gov.au/.