First Time Builder

First Home Owners’ Grant Tasmania

The First Home Owners’ Grant, HomeBuilder Grant and First Home Loan Deposit Scheme are all incredible opportunities for new home owners in Tasmania looking for financial support in entering the property market. The following guide will help you assess whether or not you’re eligible, and walk you through the most commonly asked questions about applying and the overall process.

Quick Links

- About the First Home Owners’ grant

- About The 2020 First Home Loan deposit scheme

- About The HomeBuilder Grant program

About the First Home Owners Grant

In the 2018-19 budget, the Tasmanian government announced the $20,000 new home owners grant will be available for those building or buying their first home up until and including June 30th 2019. Since then, they have announced a one-year extension of this grant for the following financial year. This means that that until June 30 2020, you may be eligible for this same level of financial assistance.

After this date, the grant will be revised to be a $10,000 payment. If you’re eligible, you may want to consider lodging your application sooner rather than later!

Eligibility

The Tasmanian government explains you are entitled to receive the grant if you have a contract for buying a new home, you are building a new home or you have a home building contract for a new home. If this is you, you can make an application through an approved agent. A detailed list of approved agents can be found on the Tasmanian government’s website. Most major banks and credit unions qualify as approved agents. However, if you wish to lodge your application yourself, you can visit a Service Tasmania shop and apply there. It’s important to note you cannot apply for the First Home Owners Grant by yourself for a contract based on an owner-builder agreement. Such a contract must be lodged through an approved agent.

If you are eligible for the First Home Owners Grant, your application will be processed within two weeks after the first lodgement. You will receive notification of the outcome in writing. It’s important to remember that the processing time for your payment will vary depending on whether your first home already exists or is being built and whether you are making the application yourself or if you are going through an approved agent.

Applying for the First Home Owners’ Grant

When should I apply for the First Home Owners Grant?

It’s key to understand that Tasmania’s $20,000 grant only applies for those contracts signed before 30th June, 2020. The grant is still available after this date, but the amount reduces by half.

What do I need to provide?

When applying for the First Home Owners Grant within Tasmania, you must also provide supporting documents as evidence that you are eligible for the grant. This documentation can vary depending on what property type your first home is. This documentation includes proof of transaction such as a signed copy of the contract for the building of your first home.

You must also provide proof of identity, confirming you are an Australian citizen or permanent resident. The proof of identity required again depends on whether you apply through an approved agent or by yourself. If applying without an approved agent, it’s key to remember more forms of identity are required and may make the process slower and more time-consuming.

Finally, you must also provide proof of completion of settlement or construction. The type of first home you are owning and/or building will determine what documentation is required. If you have a contract to build your first home or have an owner-builder agreement, you will be required to provide proof of the certificate or permit of completion or occupancy. If you are buying an existing home, you will need to supply a copy of the land title in your name as well as a solicitor or approved agent’s confirmation that the settlement has been approved and a Memorandum of Transfer that the vendor has signed.

Do I have to lodge through an agent?

We recommend submitting your application through an approved agent. The process will be far simpler and less time-consuming for you. However, if you do choose to lodge your application by yourself, be sure to refer to Tasmania’s government website for extra advice.

It’s very important to remember if you are eligible for the grant, the process to apply for the First Home Owners Grant in Tasmania will differ greatly depending on whether you lodge the application yourself or through an approved agent and whether you have an owner-builder agreement, you are buying an existing home or you are building a home.

FAQS

Does the First Home Owners Grant count towards a deposit?

Yes, you are able to use the grant towards a deposit, however it’s key to remember the $20,000 grant usually will not be enough for the majority of home deposits. The same especially applies for the $10,000 grant for those applying after 30th June 2020.

Can you use the First Home Owners Grant to buy land?

You must occupy a home for a minimum of 12 months to be eligible for the grant. You will not be eligible for the grant if you do not own any property or land. Therefore, you could buy land with the grant but that land would be based on the fact that you had a property or land to build on prior to buying that new land. You can not apply for the grant without owning any land or property.

Can you get the First Home Owners Grant if you’re married?

Yes, you are entitled to receiving the new home owners grant whether you are in a partnership or are married. The government grant for first home buyers is available to you and your partner/spouse. Being married does not affect your eligibility for the grant.

Can permanent residents get the First Home Owners Grant?

Yes. Permanent residents are entitled to receiving the government grant as well as Australian citizens.

Can you get the First Home Owners Grant twice?

No, you can’t receive the new home owners grant twice. Unfortunately, the First Home Owners Grant can only be applied for once. If you have previously received the grant, you are not eligible to receive it a second time.

Do first home buyers pay stamp duty in TAS?

Land tax and stamp duty may apply to home owners in Tasmania. Please refer to the Tasmanian government’s website to determine whether you will need to pay stamp duty or other taxes. The website has detailed and extensive information on what taxes and stamp duties may apply depending on your individual situation.

Can you get the First Home Owners Grant on existing homes?

Yes. As long as you meet the eligibility requirements for the grant, you are entitled to the First Home Owners Grant on existing homes. The home must be located within Tasmania and you must meet the aforementioned eligibility requirements. You must also remember to apply before 30th June 2020 to receive the $20,000 grant. Any applications made after this date will be entitled to a $10,000 grant.

About the 2020 First Home Loan deposit scheme

The 2020 First Home Loan Deposit Scheme began on January 1st, 2020. This scheme encourages new home buyers through financial support incentives, allowing you to buy a new home with significantly lower mortgage fees. To be exempt from extra fees, banks and lenders usually require 20% of the property’s value as part of a deposit. With this scheme in place, this number is lowered to 5%.

As part of the scheme, the government will underwrite your loan so that Lender’s Mortgage Insurance (LMI) fees do not apply. This assistance lowers some of the financial barriers that new home buyers face in Australia, which is extremely valuable for taking the first step into home ownership.

Highly valued properties are excluded, with only ‘entry properties’ considered as part of the scheme. In Tasmania, the value of the property value cannot exceed $400,000 in metro areas and $300,000 in the rest of the state. Read more about this national scheme here.

About The HomeBuilder Grant program

The HomeBuilder Grant is a nationwide stimulus package introduced by the Federal Government. It has been formulated as a direct response to the economic hardship from COVID-19 which is predicted to effect the housing industry. The grant will apply to both renovations and new homes and will total $25,000.

To qualify for the grant there are a few eligibility requirements to meet. For new homes, the property value cannot exceed $750,000. Renovations cannot exceed $150,000 and cannot include pools or tennis courts. Singles must be earning $125,000 or less based on their tax return, and couples must have a combined income of less than $200,000. This grant is a great opportunity, so take advantage of it if you can!

More information about the grant can be found here.

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

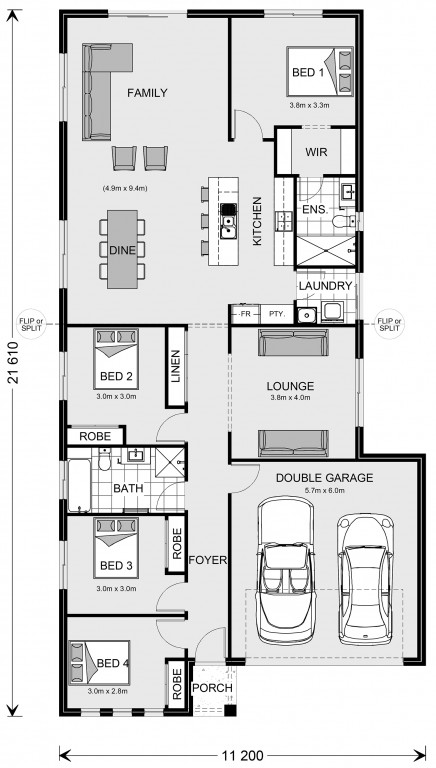

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information about the First Home Owners Grant is available at http://www.firsthome.gov.au/.